If you’re reading this, congratulations. You have almost made it to another year in DeFi while the odds were against you. We are still hanging in there when everything that could possibly go wrong is going wrong. These past few months have been very interesting in the space and to say the least there’s still opportunity and forward movement.

I’m not here to shill or give a long giga analysis but I do want to expound on some of the opportunities that have arisen and how you can be early(again). As we approach 2023, I look forward to seeing more rapid innovation and new technologies within the blockchain emerge.

Real World Assets

In the tokenization of things we are starting to see a trend of real world assets being digitized. For example we have tokenized real estate, art, collectibles, cars and more. One new sector on the scene is tokenized commodities.

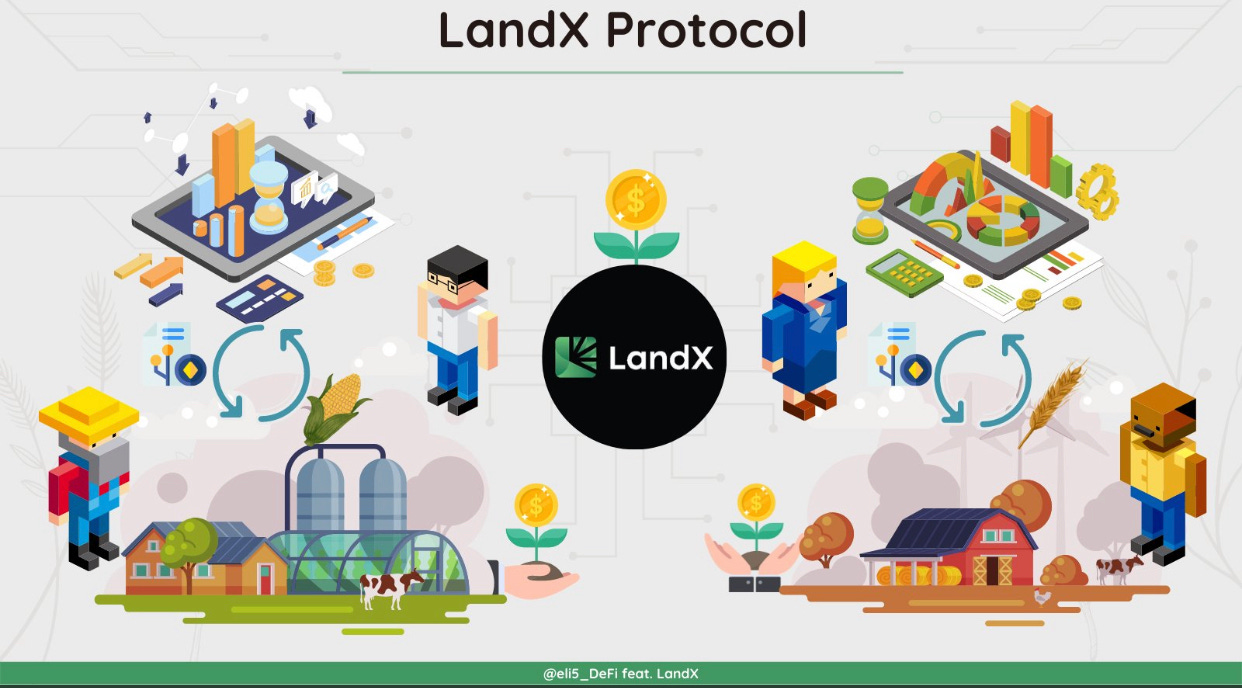

Commodities have always been a key component in macro and now we are seeing it enter the decentralized world. The demand for agriculture and land is increasing faster by the day. LandX is at the forefront by implementing on-chain commodities that both real world farmers and us DeFi farmers can take part in.

What is LandX?

LandX is a perpetual commodity vault protocol that is working on bringing commodities like corn, rice, wheat, and more on-chain. This allows farms to participate in revenue share by obtaining yield-bearing xTokens. They are implementing sustainable alternatives to the traditional commodity economy in place.

Not only are they introducing yield through revenue share but they are also providing farmland capital and rental returns. Traditional farmland can currently be rented out to earn passive income. Users can’t directly get exposure to the land, but they do receive the revenue streaming from commodities the farmland provides.

Why tokenized commodities?

In the traditional economy, supply chain costs have been getting expensive not to mention recent rises in inflation. Also, new-coming investors and traders struggle to access already have their hands all over the commodity market making it hard for other players to join the game.

How do I earn?

Whoever buys these xTokens can hold to earn yield paid out in cTokens. These cTokens can be traded for USDC. cTokens are pegged to 1kg of the current market price of the real world commodity which is pretty impressive. If you would like to enter the commodity investment realm, this could be a good opportunity to do so.

LandX is currently holding a testnet launch so if you’re interesting in participating, check it out!

Modular Blockchains

The race to solving the blockchain trilemma continues and we have new infrastructures to help accomplish it. With the current hype of Layer2s, Layer0, zkEVM, and Layer3 going on, Modular Blockchains have increased the speculation of the next major narrative!

What is a Modular Blockchain?

The original method of building blockchains was through a monolithic architecture where the single blockchain itself did everything. Think of it as the chef, waiter, and server being combined into one role. This made it hard for blockchains to specialize in certain areas and scale as a whole.

Why Modular?

The architecture of modular blockchains decouple the consensus from the execution layer actually giving the “chef, waiter, and server” their respective roles. This helps specialization and extra scalability within each sector.

Who are Key Players?

With Celestia being the first to implement this modular idea, other key players are FuelLabs, Dymension, EigenLayer, and Mantle Network. It will be interesting to see how they influence the scalability of dApps and increase the adoption of Web3 tech as a whole.

I will do a further review on these so stay tuned.

Rise of The Wallets

Wallets have always been a huge sentiment in the DeFi space. What wallet best suits my needs? Which wallet also has a browser extension? Which wallet is compatible with my hardware wallet? Which wallet has easy accessibility and will let me onboard?

There are plenty wallets that are improving features and adding new implementations. It’s ok to have multiple wallets and switch your main wallet for one that better suits your needs. Here’s a few wallets that I think are doing cool things:

Modular Wallet

We just became familiar with modular blockchains so now I introduce to you a self-custodial modular wallet. From recent previews, the UI/UX looks amazing and they will also be releasing the $MOD token along with it. They will have a IWO (Initial Wallet Offering) which is actually cool. This is my first time seeing an initial offering for a wallet. The token will be used to reward users, incentivize developers, and also distribute fees. If you would like to check it out, here’s the link.

Rainbow Wallet

The most recent news behind Rainbow Wallet is that they are soon launching a browser extension to go along with the wallet. Rainbow has a great aesthetic for a Web3 wallet and also allows onboarding directly through the wallet.

They even publicly stated that “It’s almost time to replace Metamask” which sounds pretty bullish. Due to the recent concerns surrounding geo-blocking, users may start looking for alternatives. Although Metamask recently announced a partnership with Paypal for onboarding, this still may not save them.

If you would like to check out the Rainbow Wallet extension, here’s my referral link for the waitlist.

DEX Adoption

Last but not least we have the innovation of Decentralized Exchanges. With the recent exposure and crumbling of major Centralized Exchanges, it is making more users skeptical of CEX’s and allowing them to try more decentralized methods. Remember “not your keys, not your crypto” so all-in-all this would be a good opportunity for an increase in onboarding.

Which DEX should I use?

There are plenty of DEX’s to use but it depends on what you are looking for specifically, we are beginning to see more adoption of unified cross-chain liquidity. This allows users to trade assets across multiple chains, making it more effective to get what you need.

Interoperability is becoming more popular so I wouldn’t be surprised if we started seeing blue-chips incorporate unified liquidity. These unified liquidity pools could also potentially make the pools more secure and allow users to receive boosted yields depending on what the protocol has to offer.

Honorable Mention:

One L2 DEX to keep your eye on would be Orbital DEX. This protocol was built by the Dopex & Plutus team which are reputable projects in the space. There’s not much alpha right now but we do know that it will be a native model and will include voting, bribing, liquid wraps, and partnerships!

Arbitrum still has one of the most highly anticipated airdrops coming up $ARBI and this would be a good time to implement a native DEX for users alike. DEX’s like Sushi and Uniswap may have some competition here!

Conclusion

I still see the light at the end of the tunnel and as a technology expert, DeFi is seeming to get better despite of prices and macro factors. This space is moving rapidly and the builders are going to continue to build. It’s still super early so we should expect the turbulence at the beginning of the takeoff. Most of the things going on in this space are still not fathomable to most traditional investors so we ultimately have the advantage to position ourselves wisely ahead of the herd.

Didn't know of any other project working on modular stacking aside from Celestia. Appreciate the alpha drop man.